- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Stay Ahead of the Trend With These 3 Dividend Stocks – Before They Soar

The Fed has just lowered rates by 25 basis points, the first cut in 2025, aimed at reducing inflation, among other things, and will surely alleviate some financial pressure being felt across various industries.

The result? Treasuries and other interest-generating instruments suddenly look less attractive.

Those with traditional 60/40 portfolios (or at least those holding bonds in USD) can now start thinking about rotating some into dividend stocks. Not because those bonds suddenly pay less - but because their value will have most likely risen.

The question is: Which industries should income investors be looking at to transition to? Companies operating in finance, utilities, and consumer staples certainly look more appealing, especially if they offer higher yields.

The thing is, once investors catch on, these stocks will likely rally over the next few years. All of this neatly translates into a two-pronged benefit for you.

But out of the dozens, if not hundreds, of such stocks in the market, which one should you pick?

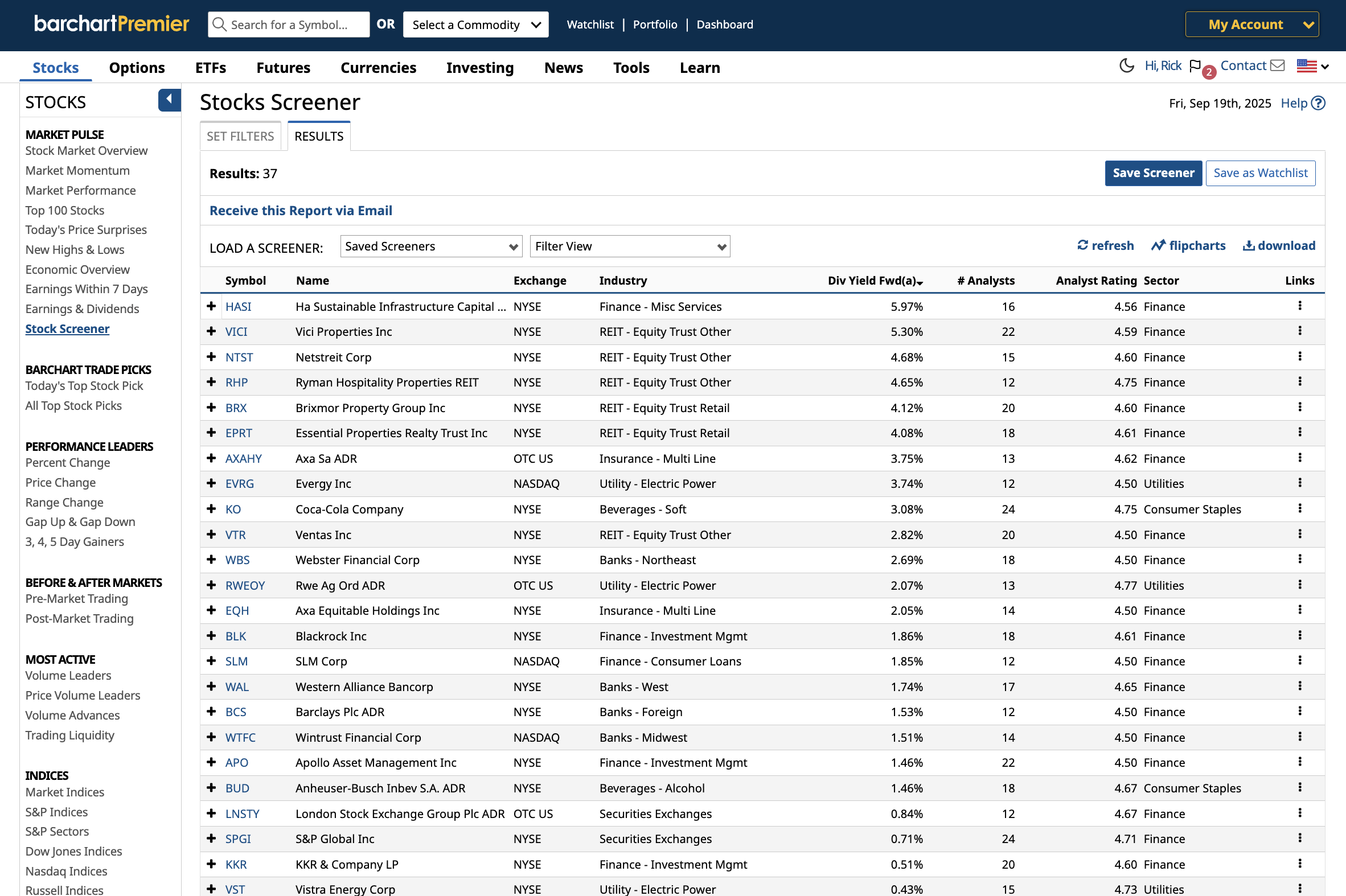

Well, Barchart’s Stock Screener makes the job easy for you. Let me show you how.

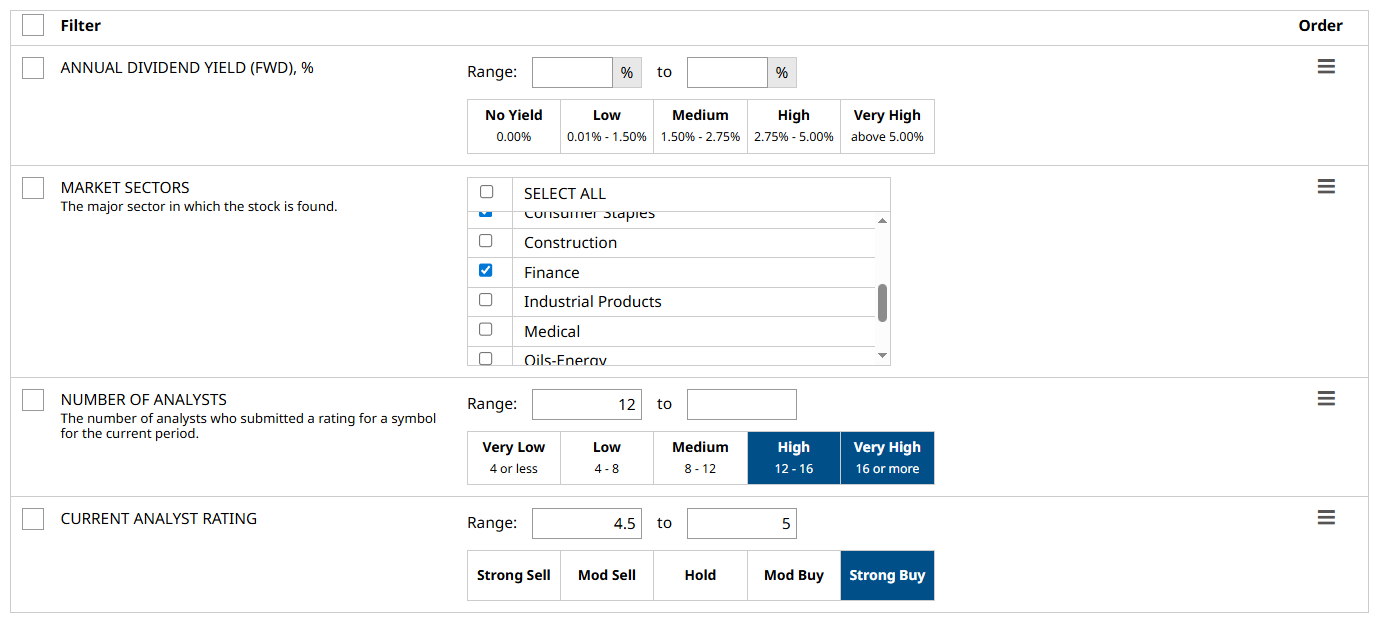

How I Came Up With The Following Stocks

The stocks featured in this list came from the following filters:

- Annual Dividend Yield (Forward): Left blank so that I can arrange the results based on them.

- Market Sectors: Consumer Staples, Finance (REITs), and Utilities. These three sectors are typically viewed as better alternatives when interest rates are cut due to their stable revenue sources, consistent cash generation, and ability to provide reliable dividend income.

- Number of Analysts & Current Analyst Rating: 12 or more, and 4.5 to 5 (Strong Buy). This combination of filters enables me to narrow down the results to some of the best-reviewed companies on Wall Street.

After running the screen, I got 37 very worthy results.

Now, you might notice that the #2-6 results are all REITs, so to avoid being concentrated into one industry, I’ll take the highest-yielding stocks from each sector.

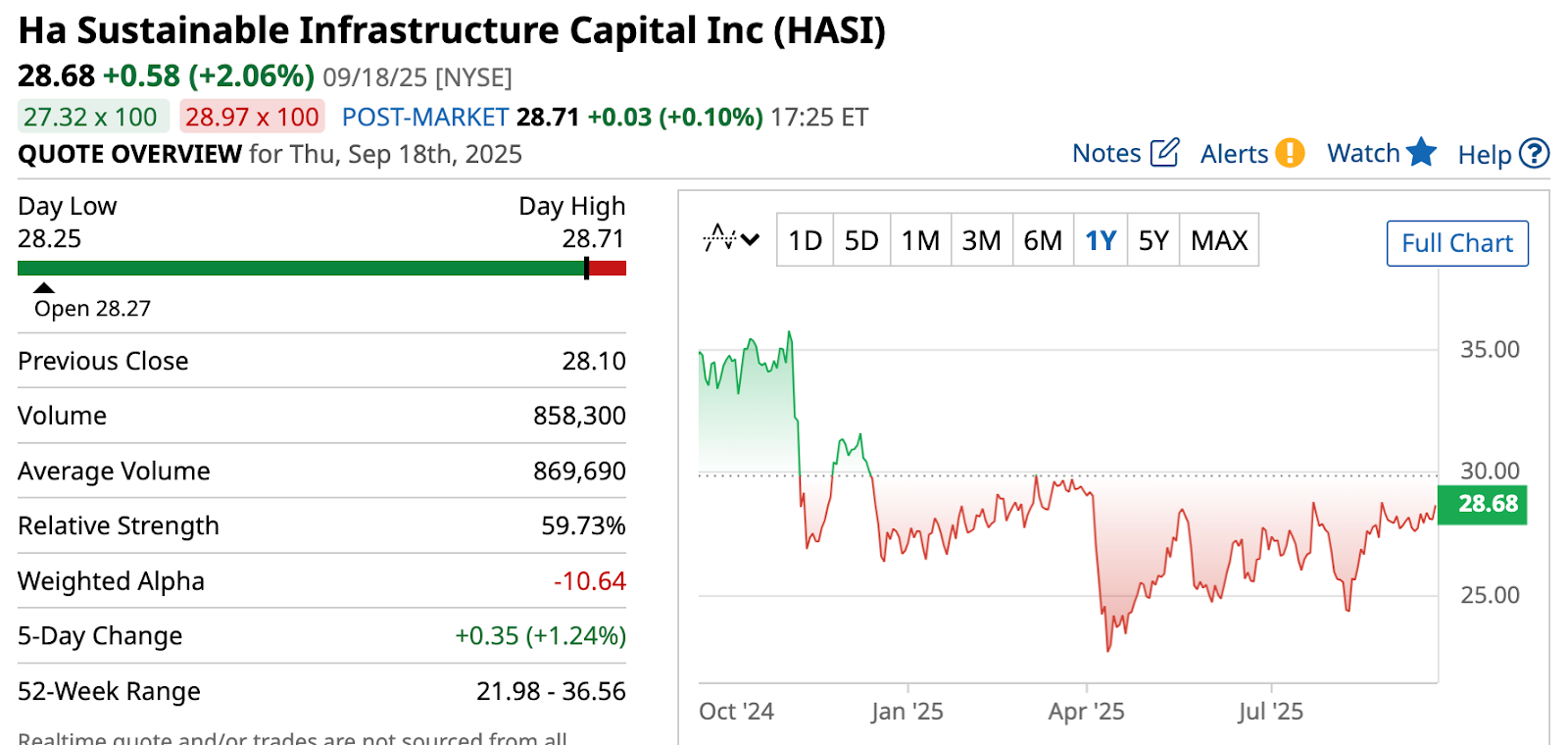

Finance: HA Sustainable Infrastructure Capital Inc (HASI)

Kicking off this list is Hannon Armstrong Sustainable Infrastructure Capital (try saying that five times fast), previously a REIT - but now a C-corp that focuses on climate-positive infrastructure projects, which means anything related to clean and green energy, energy efficiency, and climate-resilient real estate. The company has over $14 billion in managed assets, which include utility-grade solar farms, onshore wind farms, and residential properties with a significant focus on renewable energy.

Currently, the company pays 42 cents per share or $1.68 per year, which translates to a nearly 6% yield - certainly higher than any government bond these days. It's also building a history of increasing its dividends - another good sign for long-term dividend growth investors.

A consensus of 16 analysts rates HASI stock a strong buy, with an average score of 4.56. The High target price is $48, suggesting as much as 67% potential upside in the stock.

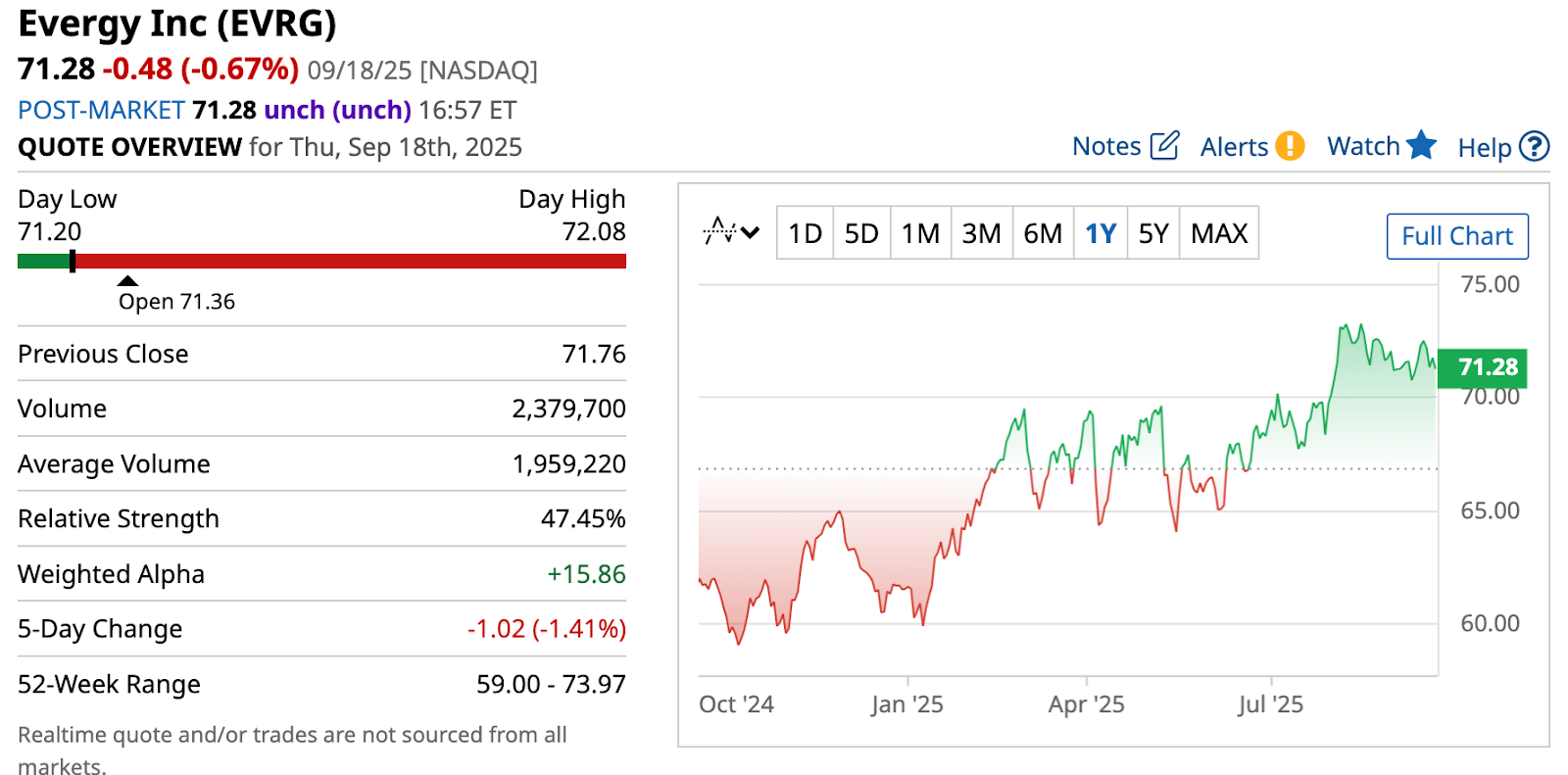

Utilities: Evergy Inc (EVRG)

Next up is Evergy, though some investors might know the company better through its subsidiaries, Kansas City Power & Light, and Westar Energy. The company serves over 1.7 million customers in Kansas and Missouri through a combination of traditional energy generation (coal, natural gas, and nuclear) and renewable sources.

Evergy pays 66.8 cents quarterly, or $2.672 a share per year, and translates to a yield of around 3.7%. The company has also increased its dividends for 21 years, so it's a few short years away from achieving Dividend Aristocrat status. Wall Street rates EVRG stock a strong buy, with an average score of 4.50. Not only that, the high target price is $79, suggesting aprox. 11% upside in the stock over the next year.

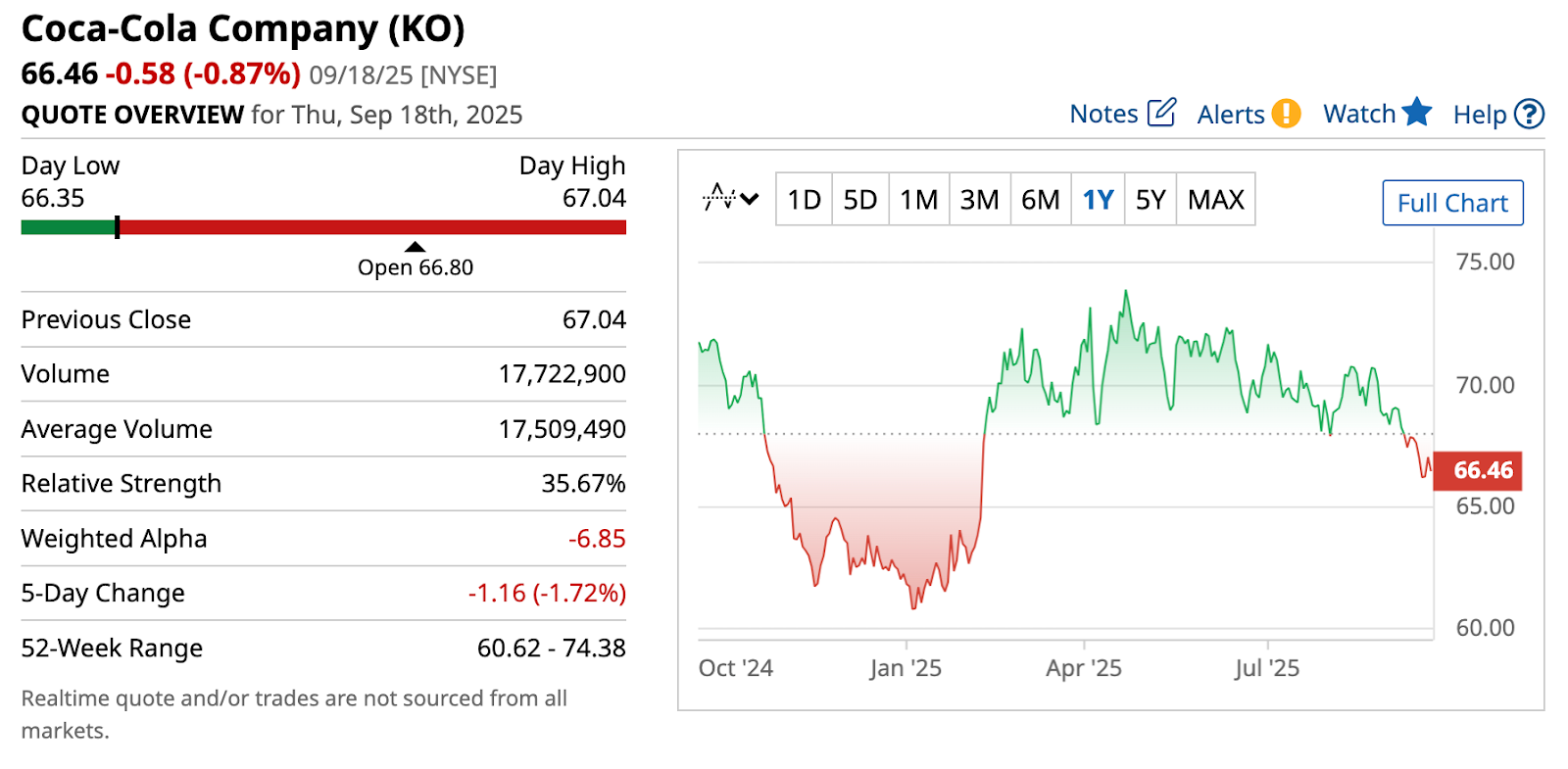

Consumer Staples: Coca-Cola Company (KO)

I’ve featured Coca-Cola in several of my top dividend stocks lists, most recently in my article covering Warren Buffett’s top dividend stocks. There's several good reasons for this: the company’s business model is resilient and diversified, it has a strong brand and pricing power, and its distribution network is almost unmatched on a global scale.

It’s also a Dividend King - a company that has increased its dividends for over 50 consecutive years - and it’s quite popular in dividend investing circles.

Right now, it pays 51 cents per share quarterly, which translates to $2.04 annually, or approximately a 3% forward yield. Meanwhile, a consensus of 24 analysts rates KO stock a strong buy with a 4.75 average score - the highest on this list. In fact, I don’t remember the last time I saw KO stock drop to a moderate buy rating. And of course, the high target price on KO? Its $85 - or about 28% from these levels.

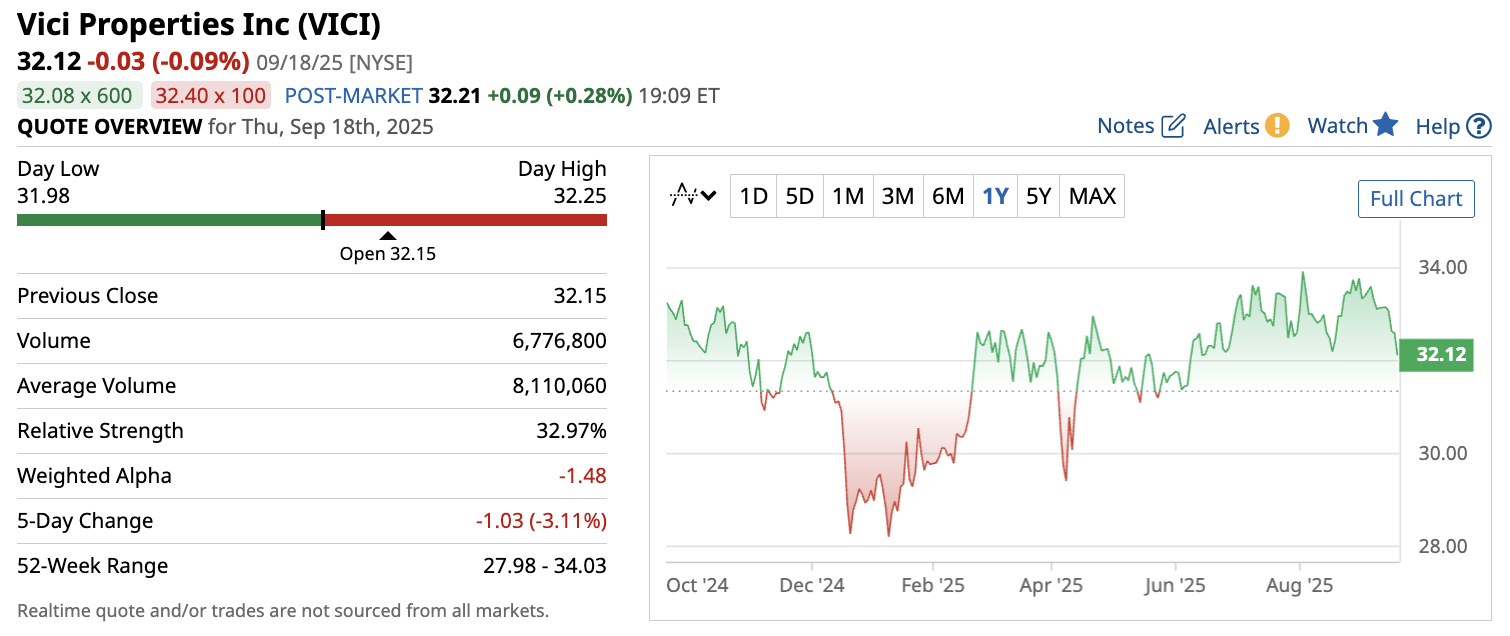

Bonus - REIT: Vici Properties Inc (VICI)

I was going to exclude Vici Properties, as it also operates in the finance sector, but I think it would be a mistake. So, as a bonus, let's talk about it.

Vici is a high-yielding REIT that owns “experiential” properties. Actually, Vici claims to be one of the largest owners of gaming real estate in the nation. Their tenants include Caesars Palace, MGM Grand, and The Venetian, all located in Las Vegas, Nevada.

Vici’s portfolio of real estate is made up of 93 assets, totaling 127 million square feet, across the US and Canada.

Vici currently pays $1.73 per share, which translates to an aproximate 5.3% yield. Not only that, a consensus among 22 analysts rate VICI stock a “Strong Buy” with a $44 price target - suggesting as much as 37% upside in the stock within the next year.

Final Thoughts

If you’ve been investing long enough, you’ll find that the headlines can be catalysts in the making.

Remember when the market plunged back in April? That was a time to buy low. And the Fed just cut interest rates today? Time to think about rotating into dividend stocks - before the trend picks up. As long as you do your research and are aware of the risks, you can take advantage of these market shifts to position your portfolio into whatever you need to focus on - growth or income - with a reasonable chance of success.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.