- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

A weak La Niña: The top of the coffee market and implications for the grain market

“A weak La Niña: The top of the coffee market and implications for the grain market”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter Edited by Scott Mathews

Below are some excerpts of our recent WeatherWealth newsletter calling the potential top in the coffee market on Tuesday and how different “flavors ”(strengths) of La Niña could have huge impacts on global weather for grains and soft commodities.

Y o u c a n n o w d o w n l o a d t h e e n t i r e r e p o r t o n S u b s t a c k

To subscribe for FREE and receive frequent reports about La Niña and commodities:

PLEASE CLICK HERE

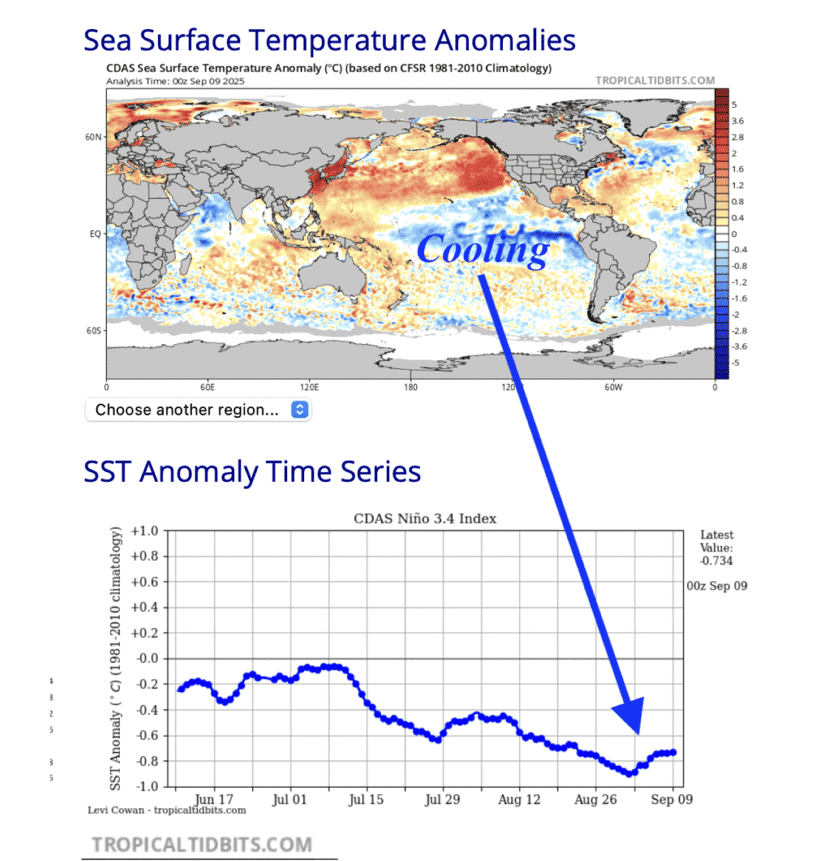

La Niña is forming and may be weak-to-moderate for the next few months. Some firms are saying the impacts will be muted as the phenomenon will not last more than a couple of months. Nevertheless, what meteorologists call a negative PDO (Pacific Decadal Oscillation Index) in the northern Pacific could extend La Niña into 2026.

However, La Niña may have to remain until May-July 2026 to warrant a major bull market in grains. Some potential global crop issues could exist from December to February in Argentina and southern Brazil that “might” result in a mini-bull market in grains, later.

Source: Tropical Tidbits (used by permission)

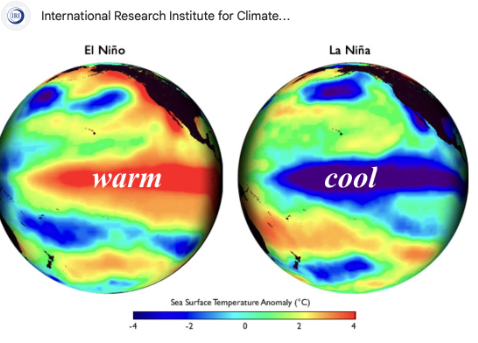

Differences between El Niño and La Niña

El Niño and La Niña are opposite phases of the ENSO climate cycle that significantly influence global weather patterns and commodity markets, but they do so in different ways:

El Niño

- Characterized by warming of the Pacific Equatorial Ocean surface waters.

- Tends to cause warmer and drier conditions in major agricultural areas like Australia and Southeast Asia, often leading to drought and reduced wheat crop yields there.

- Brings heavier rainfall to southeastern South America, western North America, and eastern Africa, which can boost production in those regions vs droughts in Sao Paulo/Minas Gerais that can hurt sugar cane and coffee production.

- Overall, El Niño often reduces global agricultural commodity production in some areas, causing supply shortages and price increases, especially for sugar, cocoa, and coffee.

- It accounts for about 20% of global commodity price inflation movements and can raise food commodity prices by 3-9% during strong events due to supply shocks.

- El Niño can also cause extreme weather events like floods, hurricanes, and droughts that disrupt production.

Source: International Research Institute for Climate and Society

La Niña

- Characterized by the cooling of the Pacific Equatorial Ocean surface waters.

- Typically leads to wetter conditions and flooding in Australia, Indonesia, and parts of Southeast Asia, benefiting crops there.

- Causes drought and heat stress in parts of the U.S., Canada, and/or Russian wheat, corn, or soybean regions during the spring and summer

- La Niña events often result in lower crop production for key Argentina and southern Brazil commodities like corn, soybeans, wheat, and sugar cane due to drought impacts in critical growing regions.

- Can have mixed results for global coffee production, with generally improved yields for Vietnamese and Indonesian Robusta. Brazil's coffee yields can vary and are more favorable during weak vs strong La Niña events

Some La Niña Topics I will discuss over the next few months

1)Whether Argentina and southern Brazil may have dry weather this winter (their summer) and resulting in a bull market in grains?

2) Could La Niña extend into the spring and summer, & the 2026 growing season, and help corn, wheat, and/or soybean prices bottom?

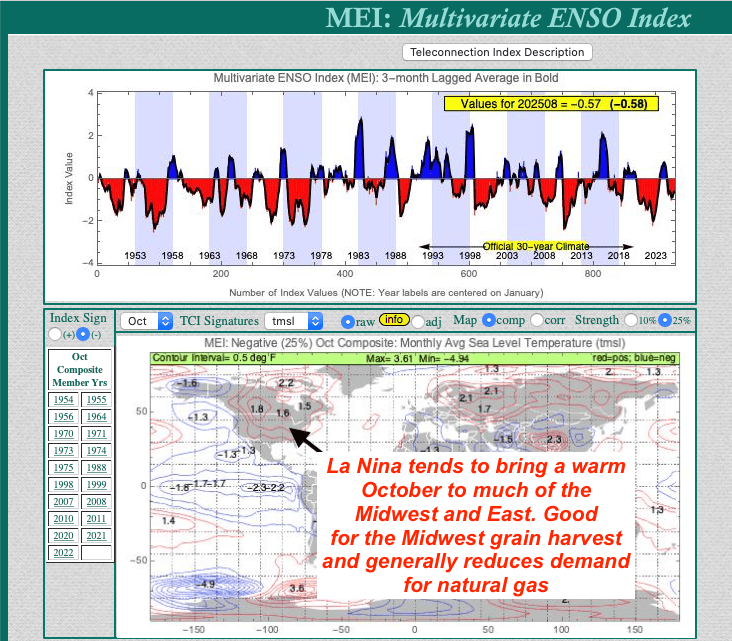

3) The possibility of a colder-than-normal start to the US winter in key natural gas and/or heating oil areas. However, warmer-than-normal US weather in October usually reduces energy demand and is often bearish for natural gas, first.

Source: Climate Predict (BestWeather, Inc. - WeatherWealth Newsletter)

4) Why weak, not strong La Niñas, could set the stage for improved Brazilian coffee weather? The caveat remains to point to Climate Change and deforestation of the Amazon; otherwise, typically, we would have a bear market in coffee later.

5) Generally improved weather for West African cocoa and below normal chances for a strong Harmattan Wind. This tends to bearish cocoa prices in 65% of these cases by winter and spring. The caveat? Here too, Climate Change and the old age of trees in West Africa.

6) Weak La Niña events tend to increase global sugar production, while stronger ones can affect production more adversely with droughts in Brazil sugar cane areas and flooding in other parts of the world.

Sign up for frequent FREE WeatherWealth reports on Substack at the top of this report, although trading ideas for multiple markets in grains, softs, and natural gas are only available here https://www.bestweatherinc.com/membership-sign-up/

Thanks For Your Interest In Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.