- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

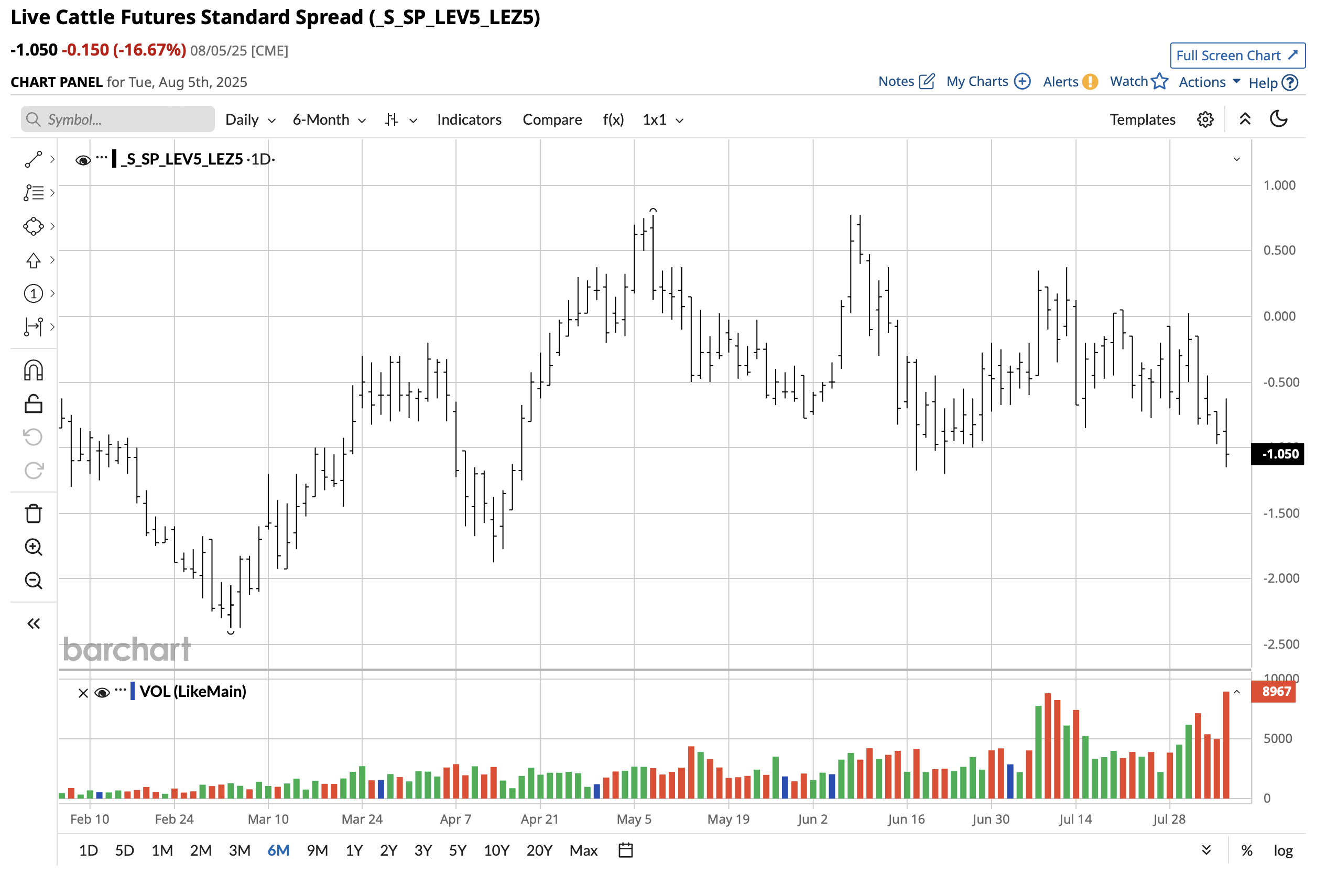

Keep those live cattle bull spreads going

I am Stephen Davis, senior market strategist at Walsh Trading, Inc., Chicago, Illinois. You can reach me at 312-878-2391.

I continue to like bull spreads in the live cattle markets. In the past few weeks, I had clients who were long August live cattle and short October live cattle. Last week that spread moved out to 6.00 points ahead of the first notice day on August 4. This was a fantastic strategy that paid off.

The next bull spread is buying October live cattle and selling December live cattle. In my opinion, this spread could move out in similar fashion 3.00, 4.00 or 5.00 points.

First notice day for October 2025 live cattle is Monday, October 6. You could be in this spread for many weeks.

This is a simple strategy and very conservative. Even in a down market, I think December live cattle will fall more than October live cattle, which is another win-win for this spread strategy.

Lower cattle placements, tight cattle supplies, Mexican border issues and higher cash cattle prices continue to drive the market. In addition, negotiations that could result in an end to Brazil's cattle exports to the U.S. are another bullish factor.

In my opinion, bull spreads will work again in the weeks ahead.

Have an excellent day and call me anytime at 312-878-2391 to discuss strategies.

Use this link to join my email list: SIGN UP NOW

Stephen Davis

Senior Market Strategist

Walsh Trading

Direct 312 878 2391

Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.